I contributi Inps per il 2022

The Inps , with the circular February 8, 2022, n. 22 , provided the payment indications, for 2022 , of the social security contributions for the subjects registered in the artisan and merchant management .

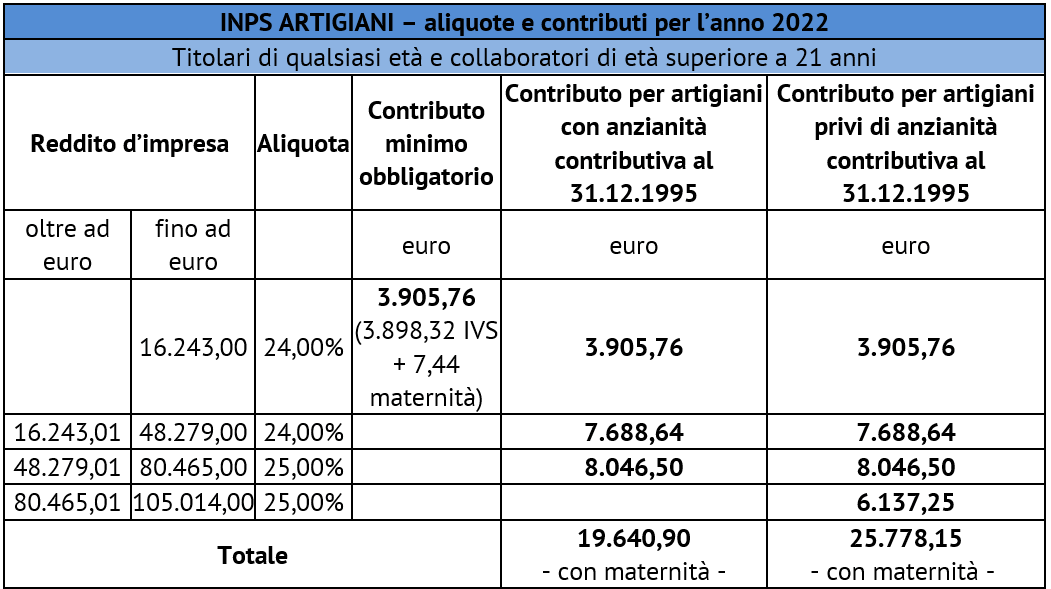

The minimum annual income to be taken into consideration, for the purposes of calculating the 2022 IVS contribution due, is equal to 16,243.00 euros , as the amount resulting from the multiplication of the minimum daily wage (49.91 euros) to 312 and adding the amount of 671.39 euros, referred to in article 6 of Law 415/1991 . On this amount must be applied:

- for artisans , the rate of 24 percent , with the exception of assistants – assistants under the age of 21, for whom contributions equal to 22.80 percent are due ;

- for traders , the rate of 24.48 percent , with the exception of assistants – assistants under the age of 21, for whom contributions equal to 23.28 percent are due .

For the share of income between 16,243.01 and 48,279.00 euros , contributions equal to:

- for artisans , 24 percent , with the exception of assistants – assistants under the age of 21, for whom contributions equal to 22.80 percent are due ;

- for traders , 25 percent , with the exception of assistants – assistants under the age of 21, for whom contributions equal to 23.28 percent are due .

Subsequently, for the share of income between 48,279.01 and 80,465.00 euros , contributions equal to:

- for artisans , 25 percent , with the exception of assistants – assistants under the age of 21, for whom contributions equal to 23.80 percent are due ;

- for traders , 25.48 percent , with the exception of assistants – assistants under the age of 21, for whom contributions equal to 24.28 percent are due .

Furthermore, only for workers without contributions seniority as of 31 December 1995 , registered with effect from 1 January 1996 or who can claim contributions seniority on that date, the annual ceiling is equal to 105,014.00 euros .

See, below, the tables differentiated between artisans and traders.

Contributions, as usual, must be paid, using the F24 payment forms , by:

- on May 16, 2022 (first installment) ;

- on 22 August 2022 (second installment) ;

- November 16, 2022 (third installment) ;

- February 18, 2023 (fourth installment) ;

within the deadline for payment of personal income tax , with reference to the contributions due on the portion of income that exceeds the minimum .

Lascia un commento